Automated appraisals could mean big changes in consumer psychology.

Convenience will always be important in consumer culture. This is easily showcased with the rise of companies like Opendoor. In the digital age, technology plays a big role in bringing consumers the most efficient experience possible.

However, automated appraisals represent a significant problem for appraisers, buyers, sellers, and agents. It would be convenient not to go through the process of an in-person appraisal. Indeed, many people may be more apt to sell. But automatic appraisals threaten to return wildly off-base estimates.

Consumer psychology

What effect might this have on the sentiments of consumers? For one thing, sellers may develop unrealistic expectations for the values of their homes. This can make it difficult for any agent to please them even though in reality it is their home, not the agent, that fails to perform up to expectations.

via Mic: Automated appraisals may convince home sellers their home is more valuable than it is.

Once again, the promise of convenience rears its ugly head. Automated evaluations are cheaper than in-person appraisals. However, they don’t account for property conditions. They take other data into consideration, but neglect this all-important variable.

There is simply no way to account for property conditions in an automated way. It is unlikely that such a technology will emerge any time soon. As it stands, in-person appraisals are the only thing that can render an “accurate” estimate for the value of a home.

How does this affect the real estate industry?

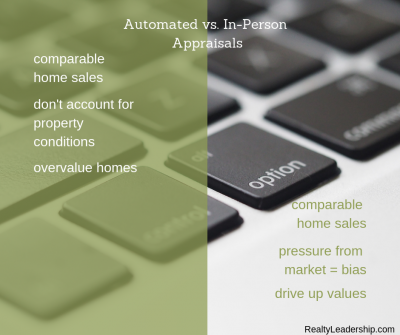

Automated evaluations take into account things like comparable home sales. Human appraisals take into account the sales of nearby and comparable homes as well. However, whereas automated evaluations risk overvaluing a property, in-person appraisers face a different issue.

In certain market conditions, there can be a significant amount of pressure on appraisers to hit a certain value mark. This fact has the ability to drive up home prices when it occurs in aggregate.

Appraisal, whether performed by human or program, seems to be bent toward the seller. After all, it is from the buyer’s pockets that the fee for this appraisal comes. There are balancing forces in place, however, that will emerge even further as this technology evolves.

Objectivity, subjectivity, and you

Automatic appraisals suffer from their objectivity. They can only work with the data they have, and that data is often incomplete. In-person appraisals, on the other hand, suffer from their subjectivity and the comorbid human error.

Will the rise of automated appraisals present a converse problem? Without the pressure on appraisers to meet certain values, we might very well see marked shifts in home valuations and therefore home prices. This potential shift could be tempered by sellers’ heightened expectations.

One thing is certain, however: real estate agents will need to adapt. Zillow already offers an online estimating tool called Zestimate. More companies are soon to follow, catering to the needs of consumers for convenience.

via Mortgage Loan: Automation means convenience, but not always accuracy.

Real estate agents will need to act as both counselors and negotiators more than ever before. As an agent, you will be required to field the issues raised by buyers who expected a home in better condition given the value they were presented with. Optimistic sellers present an even larger challenge for negotiation.

In order to prepare for this advancement, you will need to work on personal development and professional skills and, most importantly, keep your eye and your mind open for new developments.

Where do we send your free Great Agent demo?

Where do we send your free Great Agent demo?

We just need some facts about your organization:

We just need some facts about your organization:

COMMENTS