Buying a home is anything but easy, and that’s where you come in.

Buying a home can seem impossible for many people, and for a variety of different reasons. Many millennials feel they can’t get high-enough-paying jobs. Members of older generations are convinced they can’t keep up with the changing economy. Just about everyone could use a bit of encouragement.

Encouragement, however, can’t come from just anywhere. It needs to come from a credible source. People want to feel confident in others’ confidence in them. This enables them to build confidence in themselves. Fostering this sense of confidence takes diplomatic skill and real estate expertise.

Can you help consumers see buying a home as easy? Probably not. But you can definitely make it seem possible, and even rewarding. The key is in understanding where their fears are coming from based on demographics and personalities.

The demographics of fear

Fear, though irrational, is very often logically valid. It is conditioned by years of watching friends, family, and the population at large make mistakes or risk financial pitfalls. This can lead to people acting anywhere from despondent to reckless. Neither end of the scale is going to make home-buying seem any easier. In fact, it might concretely make it harder.

via An Optical Illusion: Consumer perceptions of their own situations can make those very situations more difficult.

Fear arises from different sources for different demographics. The most prominent in this decade is the seeming reticence of millennials to approach buying a home. Part of this prevalence is due to more and more millennials coming of homebuying age.

However, it is also no myth that obstacles are plentiful. Between student loans and the difficulty of attaining more than entry-level jobs, millennials’ fears have a lot of basis in reality. But living in the confines of those fears perpetuates a self-fulfilling prophecy.

Older generations, on the other hand, may still be supporting adult children. They also may be incurring increasing medical bills. Most significantly, the economic upheaval in America can make them extremely cautious. This happens particularly when it comes to purchasing a new home. It can be the case even if it would make more financial sense for them, at their age, to downsize or relocate.

You are the bridge to possibility

In some cases, consumers may know better but be unwilling to take the leap. Many instances occur, however, in which potential clients truly believe that buying a home is not a feasible option for them.

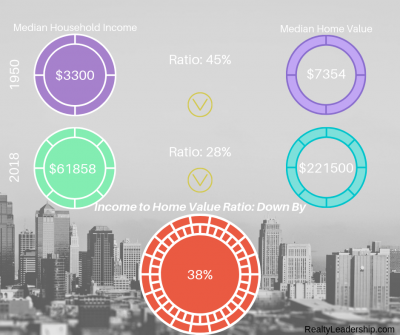

Like landing an entry-level job, purchasing an entry-level home is increasingly difficult in today’s market. Upward trends in household median income have not been proportional to the increase in median home value since 1950.

The ratio of median household income to median home value has dropped by almost 40% since 1950.

The best thing you can do for your clients is to understand and anticipate where they’re coming from. Consider their demographics. What kind of neighborhood are they from and what kind do they aspire to? Do generational factors play in? What is their credit situation?

Your background should be enough to answer questions they didn’t even know they had. Home purchasing seems like an opaque and convoluted ordeal from the outside. Show them that nothing is impossible with the right agent by their side. Buying a home may not be easy, but you can help it become possible.

Where do we send your Great Agent pricing info?

Where do we send your Great Agent pricing info?

We just need some facts about your organization:

We just need some facts about your organization:

COMMENTS