DocuSign's IPO could either have a positive or negative effect on real estate.

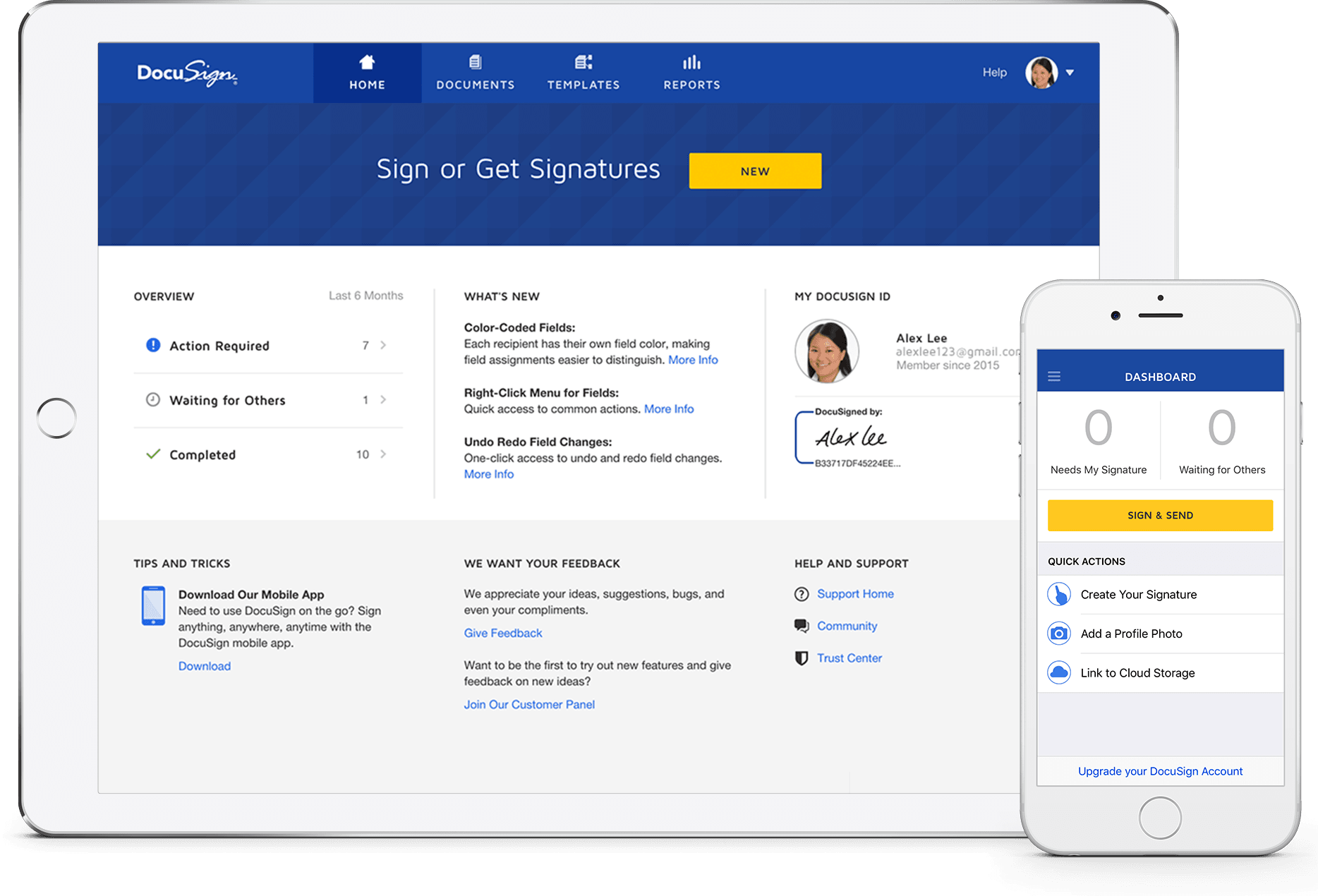

E-signature company DocuSign, widely known throughout the real estate community, is reportedly going public and opening itself up to shareholders within the next six months.

This is an exciting step for the company, as it is a test on how the public will react to its shares. DocuSign first launched in 2003, and since then has become a multi-million-dollar company ($500 million, to be exact.) Their forthcoming IPO (initial public offering) will be their next big step in gaining traction as a company – and it is

predicted that a lot of traction will be gained.

So, what does this mean for the real estate market, exactly? Well, that depends on how well DocuSign is received by the public. If the IPO is a raging success, then they could become even bigger throughout the real estate market. However, if they are not received well, it could potentially hurt the real estate market, in that DocuSign’s shares may take a hit.

So, what does this mean for the real estate market, exactly? Well, that depends on how well DocuSign is received by the public. If the IPO is a raging success, then they could become even bigger throughout the real estate market. However, if they are not received well, it could potentially hurt the real estate market, in that DocuSign’s shares may take a hit.

Luckily though, the future is looking bright for DocuSign (and for real estate as a result.) Since the company has already made such a big name for itself, and has become s successful throughout the past years, it can only be inferred that they will follow on that trend.

If you do not already use DocuSign as an e-signature platform, now would be a better time than ever to team up with them. With a big name such as this on the rise, clients will be sure to take notice. DocuSign is a great platform that allows for transactions to be made virtually (thus allowing for more opportunities for out-of-state clients) and it will be sure to blow up even further after their initial public offering is released. It is a good idea to partner with them while they’re hot – they’ll only go up from here.

Where do we send your free Great Agent demo?

Where do we send your free Great Agent demo?

We just need some facts about your organization:

We just need some facts about your organization:

COMMENTS