Help your clients see exactly what they’re paying for.

It’s no secret that buying a home can be a stressful and mind-boggling experience. A client looking for a new home may be stymied by all of the options available, and the vast differences between all of these options. Though they may be sure on an intuitive level what they want out of a home, it can be very hard to give concrete words to these desires, and even harder to equate their preferences to a willingness to purchase a home for a given price.

This is a useful way to help clients visualize what they’re paying for in a new home and how such an investment lines up with their personal goals and values in life. This, in turn, makes for a more successful home buying experience and a better relationship between you and your clients.

First, go over their budget with them and get a clear understanding of what they believe they are paying for in a home. Are they paying for safety and security? A good neighborhood to raise kids? Proximity to schools, offices, or nature? Space for a certain number of children and a certain number of pets? Extra features like smart home technology or amenities like a pool or three-car garage? Have them settle on a top ten list.

This list should be different from a wish list in that it is not just a collection of features your clients want, but features they believe they are paying for when they buy a house. In other words, these are the boxes they will check to make sure they are getting their money’s worth. It’s not about what makes the ideal home; it’s about what makes a home a home, period. It’s about translating dollar values to actual, personal values.

A client might want hardwood floors and a walk-in closet, but perhaps the walk-in is something they just think would be convenient while hardwood floors are important to them for those occasions when they invite their colleagues to visit. Whatever their reasons for each desire, it’s likely that some are more connected to personal values, worldviews, and social networks than others, and they will appreciate these factors being brought into consideration and discussion.

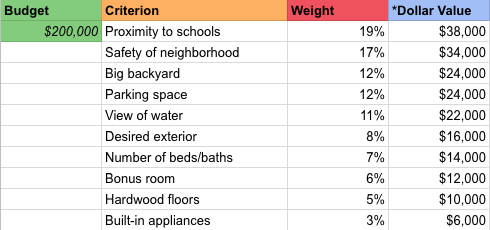

Once your clients have generated the list, have them order the list from most to least important, and weight each item by percentage of importance. It’s okay to have a “miscellaneous” category that encompasses other factors that may not have made the top ten, so they feel that they have covered all of their bases.

Next, crunch the numbers for them (a simple act that adds personal touch and investment) and show them exactly what dollar amount they have assigned to each criterion they have for their new home. You can make your own copy of this spreadsheet and edit it with your clients; the formulas are already in place to calculate dollar values based on percentages.

This spreadsheet can help clients visualize exactly what they’re investing in.

If you want to go a step further, you can discuss this set of values each time you show them a house, tailoring the dollar amount to the price of that particular home, and examining how it stacks up against the “values budget” they have made.

This allows for some peace of mind and a safeguard against getting overwhelmed by the presence or lack of key features in a potential home. It helps clients not to “fall in love” with a property to the degree that they can’t see reason, and on the other end of the spectrum, it makes them less likely to dismiss a suitable home too quickly. Most importantly, it allows a buyer to feel confident that not only is their agent aware of their needs, but they have developed an increased awareness of these needs as well.

Where do we send your free Great Agent demo?

Where do we send your free Great Agent demo?

We just need some facts about your organization:

We just need some facts about your organization:

COMMENTS