Berkshire Hathaway has made its second investment in real estate this year, acquiring a 9.8% stake in Store Capital Corp for $337 million dollars. However, who is Store Capital Corp?

Berkshire Hathaway, Warren Buffett’s multi-billion holding company, has made a $377 million investment in the real estate sector. It recently acquired a 9.8% stake in Store Capital Corp., a real estate investment trust based in Arizona. This move made it the third largest shareholder behind Vanguard Group and Fidelity Management & Research.

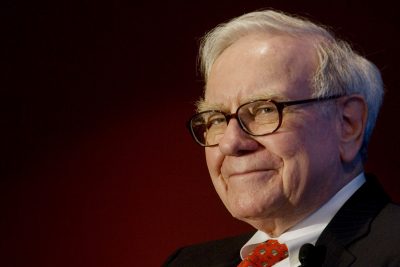

Warren Buffett’s latest move in real estate.

Christopher Volk, Store CEO, stated, “An investment in our company from one of the history’s most admired investors represents a vote of confidence in our experienced leadership team and an affirmation of our profit-center real estate investment and management approach”. He added, “Berkshire Hathaway’s investment solidly positions STORE for continued growth while adding measurably to our already strong financial position”.

What is Store Capital Corp?

Store is a REIT, real estate investment trust, meaning it focuses more on income producing real estate. They focus on service properties such as movie theaters, health clubs, pet-cares, pre-school facilities, and furniture stores. Less than one-fifth of its portfolio is invested in traditional retail according to Bloomberg.

Unlike other real estate companies, Store acts more like a finance company. Tenants are the ones that cover the costs of operating the property, which includes taxes, insurance, and maintenance. Store gives finance to middle-market tenants who do not have access to affordable capital.

Shares Increase

After Warren Buffett’s investment in the company, Store saw an 11% increase in its shares, the largest increase it had since 2014 when the company first went public. However, the company has had a 16% slip since the start of this year. With Warren Buffett behind Store, many believe that the company’s shares will continue to grow. However, for how long is a different matter.

Where do we send your free Great Agent demo?

Where do we send your free Great Agent demo?

We just need some facts about your organization:

We just need some facts about your organization:

COMMENTS